The Integrated Sustainability Data Ecosystem for Real Estate

Combining Collection, Analytics and Reporting

1

. Executive Summary

Sustainability data has become a critical input into real estate investment strategy. What began as a compliance driven reporting exercise has evolved into a core component of risk management, asset performance optimization, and capital allocation. Institutional investors are now expected to demonstrate not only transparency, but control, consistency, and credibility across their sustainability data.

Despite this shift, sustainability data management in real estate remains fragmented. Utility data is often incomplete or manually collected. Asset level analytics are disconnected from operational decision making. Portfolio reporting is handled separately, frequently under time pressure and with limited traceability. The result is high operational burden, inconsistent outputs, and limited confidence in the numbers used for both reporting and strategy.

At the same time, regulatory and investor pressure continues to increase. CSRD, SFDR, EU Taxonomy, and GRESB require higher data quality, clearer methodologies, and stronger links between asset performance and portfolio level outcomes. Forward looking analysis, such as net zero pathways and CRREM alignment, is becoming a baseline expectation rather than a differentiator.

This white paper presents a practical sustainability data blueprint for institutional real estate investors, developed collaboratively by three specialized companies; iqbi, Next Sense and Scaler. The approach is structured around three core pillars: utility data collection, asset-level analytics and optimization, and portfolio analytics and reporting. Each pillar is led by a partner with strong real estate domain expertise, with a continuous flow of data from source to portfolio-level strategy.

The blueprint also recognizes a critical success factor that is often overlooked: execution at property management level. Advisory and implementation support, provided by Colliers, plays a key role in bridging the gap between data driven insights and real world operational change.

Together, iqbi, Next Sense, Scaler and Colliers form a coherent sustainability data ecosystem that moves beyond fragmented compliance and enables investors to manage sustainability as a core investment discipline.

2. The Challenge Facing Institutional Real Estate Investors

2.1 Data Collection Gaps at Asset Level

Reliable sustainability management starts with reliable source data. In real estate, this primarily means energy, water, and increasingly tenant consumption data. Yet many institutional portfolios still struggle with incomplete coverage, inconsistent formats, and manual data collection processes.

Common challenges include limited access to tenant meters, fragmented utility provider landscapes across countries, and unclear responsibilities between owners, asset managers, and property managers. In many cases, sustainability teams rely on spreadsheets, emails, and estimates to fill data gaps.

These gaps undermine confidence in reported figures and make it difficult to track performance improvements over time. They also pose a growing risk as regulatory frameworks increasingly require primary data, transparency on assumptions, and audit ready documentation.

2.2 Analytics Complexity and Underused Data

Even when data is available, turning it into insight remains a challenge. Raw utility data is granular, noisy, and highly contextual. Without normalization for factors such as weather, occupancy, and asset use, it is difficult to compare performance, much less identify inefficiencies.

Many organizations generate dashboards that aggregate data and look informative, but fail to clearly translate it into actions for improvement. Asset managers may see that a building is underperforming, but lack clarity on what is causing this and how to prioritize possible interventions to serve only as vehicles for sustainability reporting rather than a facilitator for day to day operational asset management. The opportunity to use the data to its full potential and thereby reduce operating costs, improve resilience, and enhance asset value remains largely untapped.

2.3 Regulatory Pressure and Expanding Scope

The regulatory environment for sustainability reporting is becoming more demanding and more interconnected. At the building level, requirements such as the Energy Performance of Buildings Directive (EPBD) and its Building Automation and Control Systems (BACS) mandate are pushing asset owners to implement continuous monitoring, control, and data availability as a prerequisite for compliance.

Against this backdrop, CSRD introduces mandatory, standardized, and assured reporting. SFDR requires transparency on sustainability risks and impacts at both entity and product level. EU Taxonomy demands detailed technical screening of assets. GRESB continues to evolve, placing increasing emphasis on performance and validation.

Crucially, many of these requirements extend beyond historical reporting. Investors are expected to define transition plans, demonstrate progress toward net zero, and assess alignment with pathways such as CRREM. This becomes challenging when data is fragmented and insights lack operational depth.

2.4 The Reporting and Execution Gap

The cumulative effect of data gaps, analytics complexity, and regulatory pressure is a significant operational burden. Sustainability teams spend disproportionate amounts of time chasing data and reconciling inconsistencies. Asset managers are asked to provide inputs without always understanding the purpose or value.

At the same time, a gap often emerges between sustainability strategy and execution. Portfolio level goals are defined, but property management teams are not always equipped or aligned to deliver against them. Without clear accountability and translation into operational processes, sustainability ambitions risk remaining theoretical.

3. The Blueprint: Three Pillars of Sustainability Data

An effective sustainability data strategy for real estate is built on three interconnected pillars. Each pillar addresses a specific part of the data lifecycle, while integration ensures that value is added at every stage.

Pillar 1: Utility Data Collection with iqbi

Utility data collection creates the foundation of the sustainability data stack. Without complete, accurate, and timely source data, analytics and reporting cannot be trusted.

iqbi specializes in real-time automated utility data acquisition across complex real estate portfolios, both at building and apartment-level. This includes direct integrations with utility providers, smart meter platforms, and building systems, as well as structured processes for tenant data capture. iqbi combines its software approach with targeted hardware installations to ensure total data coverage while minimizing manual effort. Each setup is tailored to the client’s specific needs, depending on asset types, countries involved, and existing systems. Operating across 21 European countries, iqbi brings deep country-level regulatory knowledge, enabling precise project planning and implementation aligned with local requirements, while maintaining portfolio-wide consistency.

One of the most persistent challenges in sustainability management is the lack of reliable, traceable data. By centralizing and standardizing data collection, iqbi directly addresses this issue. Data becomes traceable to its original source, improving transparency and audit readiness, while sustainability teams gain confidence in the numbers they work with and asset teams gain visibility into actual consumption patterns.

Klaas Nijssen, Founder & CEO of iqbi:

“Everything downstream depends on the quality of the source data. If your utility data is incomplete or inconsistent, every analysis and report built on top of it is compromised. Our focus is on real-time, verifiable data that teams can rely on as a single source of truth.”

Pillar 2: Asset Analytics and Optimization with Next Sense

Once reliable data is in place, the next challenge is translating it into decision-ready insights at the asset level. This pillar is where sustainability data moves from measurement to management.

Next Sense provides building-level performance analytics that translate raw consumption data into clear, operationally relevant insights for asset and technical teams. Where available, utility data is enriched with operational inputs from building management systems, creating transparency into how technical installations, control strategies, and usage patterns influence actual performance. Data is normalized for external factors such as weather and occupancy, enabling meaningful comparison across time, assets, and portfolios.

This pillar goes beyond basic diagnostics. Insights are directly linked to concrete operational measures, allowing asset managers to identify inefficiencies, prioritize interventions, and monitor the impact of improvements over time. This ensures that performance improvement is based on measured outcomes rather than assumptions or static benchmarks.

Ferdinand Grapperhaus, Founder & CEO of Next Sense:

“Data only creates value when it informs better decisions at the building level. Our role is to translate complex performance data into clear, actionable signals for asset teams, so they can act with confidence and understand the impact of those actions over time.”

By embedding performance insights into day-to-day asset management, this pillar turns sustainability data into a continuous performance management capability. It supports cost efficiency, operational resilience, and risk reduction, while providing a robust and credible foundation for portfolio-level reporting and transition planning.

Pillar 3: Portfolio Analytics and Reporting with Scaler

The final pillar connects asset level performance to portfolio strategy, regulatory compliance, and investor disclosure.

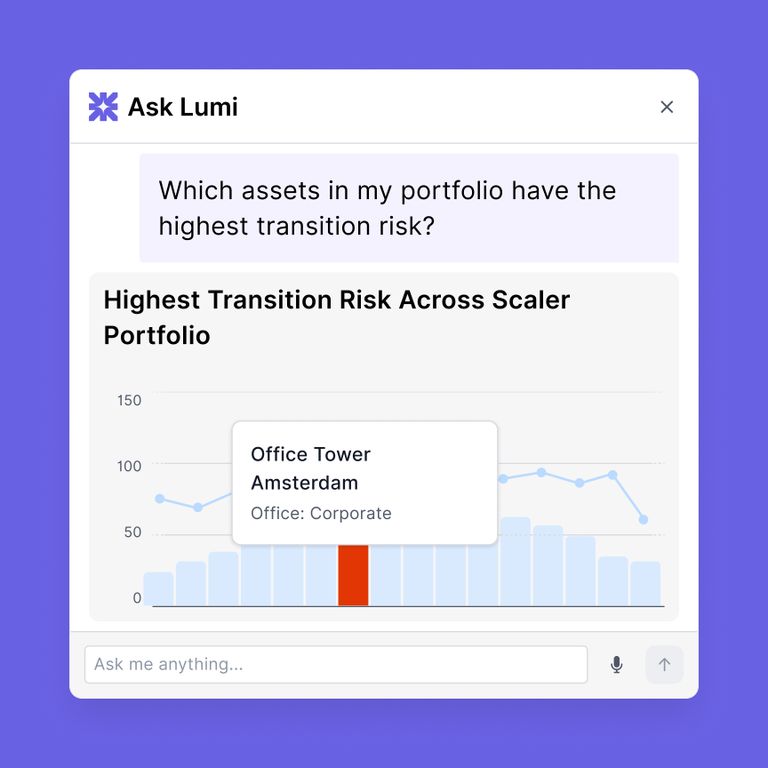

Scaler provides a centralized platform for portfolio analytics, sustainability reporting, and transition pathway modeling. Validated asset level data flows into a consistent portfolio view, enabling reporting against frameworks such as CSRD, SFDR, EU Taxonomy, and GRESB without duplicating effort.

Scaler also supports forward looking analysis, including net zero pathway modeling and CRREM alignment. This allows investors to assess transition risk, prioritize capital expenditure, and align sustainability strategy with investment decision making.

Luc van de Boom, Founder of Scaler:

“Investors need to understand how asset level performance translates into portfolio risk, return, and compliance. Our focus is on connecting buildings, regulation, and investment strategy through data that is robust enough for assurance and practical enough for decision making.”

4. Bridging Strategy and Execution: The Role of Colliers

Technology alone does not deliver sustainability outcomes. Execution happens at property and asset management level, where data driven insights must be translated into operational decisions.

Colliers plays a critical enabling role in this ecosystem by bridging the gap between sustainability strategy, data platforms, and property management execution. As an advisor and implementation partner, Colliers supports investors in embedding sustainability objectives into asset management strategies, property management mandates, and service provider contracts.

This role is particularly important in portfolios where responsibilities are fragmented across owners, asset managers, and managing agents. Colliers helps ensure that insights generated through iqbi, Next Sense, and Scaler are understood, prioritized, and acted upon on the ground.

Robin Swane, Sustainability Advisor, Colliers:

“The biggest challenge is not a lack of ambition or data, but the gap between portfolio level sustainability goals and what happens at building level. Bridging that gap requires clear data, clear accountability, and close collaboration with property management teams. When those elements come together, sustainability starts delivering real operational results.”

By aligning governance, accountability, and execution, Colliers ensures that sustainability data translates into measurable performance improvements.

5. The Integrated Value Chain

Each layer adds value in a clear sequence. Utility data collection by iqbi ensures accurate and complete inputs. Asset-level analytics with Next Sense translate this data into operational insight. Portfolio reporting by Scaler connects performance to strategy, regulation, and investor-grade disclosure, while advisory support ensures insights are executed effectively. Feedback loops between portfolio objectives and asset-level actions create a continuous improvement cycle rather than static reporting.

Together, this integrated ecosystem enables investors to move from fragmented sustainability efforts to a coordinated, performance-driven approach. By connecting data, decisions, and execution, sustainability becomes a core investment discipline rather than a reporting obligation.

6. Illustrative Use Case: An Institutional Investor in Practice

Consider a diversified European real estate investor with offices, logistics, and residential assets across multiple countries. The organization faces CSRD reporting obligations, increasing investor scrutiny on net zero commitments, and rising operational costs.

First, iqbi is deployed to automate utility data collection across the portfolio by directly connecting to meters or installing hardware where needed. This replaces manual reporting and fragmented systems, significantly improving data coverage and reducing reliance on estimates. As a result, sustainability teams gain visibility into consumption patterns and greater confidence in the data they use.

Next Sense ingests this data and applies asset-level performance analytics to identify underperforming buildings and optimization opportunities. Asset managers receive clear, decision-ready insights, supported by Next Sense’s platform and Building Experts, enabling targeted operational improvements at building level.

Scaler then aggregates validated data into a portfolio view. Net zero pathways are modeled, CRREM alignment is assessed, and regulatory disclosures are prepared using a single data backbone.

Throughout the process, Colliers supports implementation by aligning property management teams, embedding sustainability KPIs into operational processes, and ensuring that insights translate into action on the ground.

The result is a sustainability data ecosystem that supports compliance, performance improvement, and strategic decision making without increasing complexity.

7. Conclusion and Call to Action

Sustainability data is now a core investment input for institutional real estate. Managing it through fragmented tools and manual processes is increasingly risky and inefficient.

The sustainability data blueprint outlined in this paper offers a practical alternative. By integrating utility data collection, asset analytics, portfolio reporting, and advisory support, investors can build a data stack that is robust, scalable, and execution focused.

iqbi, Next Sense, Scaler, and Colliers together enable a shift from reactive reporting to proactive asset & sustainability management. For CIOs, sustainability leaders, and asset managers, this integrated approach delivers lower operational burden, higher data credibility, and sustainability insights that directly support investment decisions.

The competitive advantage lies not in collecting more data, but in connecting and utilizing it to its full potential.